Calgary Sees Declines in Sales, with Mixed Trends by Property Type

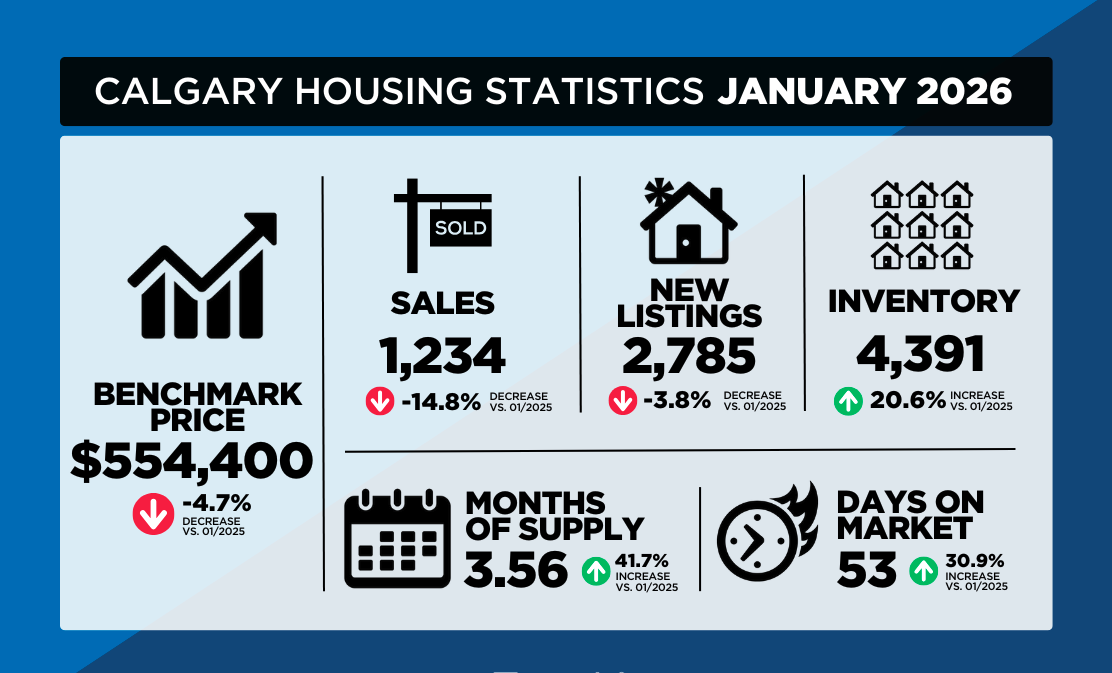

The real estate market in Calgary showed a mixed performance in January, with a notable decrease in overall sales compared to the previous year. Calgary recorded 1,234 sales, marking a 15% year-over-year decline. Despite this drop, the figure was in line with the typical activity levels for January. A closer look at property types revealed that higher-density homes, such as row and apartment-style units, experienced the steepest declines. This downturn can be attributed to several factors, including a general hesitation among potential buyers following the traditional December slowdown, and a reduction in urgency as more listings entered the market. While both buyers and sellers appear to be adjusting their strategies, this shift is not unexpected for the season, as many await the arrival of spring to make more definitive moves.

The dynamics of supply and demand played a significant role in shaping the market conditions in Calgary in January. The number of new listings outpaced the sales, causing a rise in inventory levels, which reached 4,391 units—the highest for a January since 2020. This surge in inventory was particularly noticeable in higher-density homes, such as row and apartment-style units, where supply exceeded the demand. As a result, the months of supply for different property types varied significantly, ranging from just under three months for detached homes to over five months for apartment-style homes. These varying levels of supply indicate that buyers’ preferences and market conditions differ based on property type, with detached homes maintaining relatively balanced conditions while higher-density homes faced more inventory pressure.

In terms of pricing, Calgary’s real estate market saw a general decline in benchmark prices compared to the start of the previous year. This was particularly evident in the row and apartment-style homes, where oversupply caused significant price reductions. However, seasonally adjusted figures showed stable pricing compared to the end of 2025, reflecting some price stabilization. Detached homes, for instance, saw a slight decrease in the benchmark price, dropping to $724,000 in January, which is over 3% lower than the previous year. In contrast, semi-detached homes showed more price stability, with only a slight decrease from January 2025. While there were localized price declines in certain districts, the overall trend indicated a mixed but stable price environment, especially in the detached and semi-detached segments.

The regional markets surrounding Calgary—specifically Airdrie, Cochrane, and Okotoks—exhibited varied conditions. Airdrie, though seeing a decline in sales from last January, still experienced relatively strong market activity, with the sales-to-new-listings ratio at 47%. This kept inventory levels within long-term trends, and prices showed modest gains on a monthly basis, despite being down 5% compared to January 2025. In contrast, Cochrane saw a significant rise in new listings, leading to a drop in the sales-to-new-listings ratio to 36%. With inventory levels rising, the months of supply increased to five months, and prices trended down for the third consecutive month. Okotoks, on the other hand, continued to struggle with limited inventory, which restricted sales activity. Despite a relatively high sales-to-new-listings ratio of 63%, the number of units available for sale remained low, keeping months of supply at just over two months. As a result, prices in Okotoks remained relatively stable month-over-month, although they were still 2% lower than the previous year.

The market for higher-density homes, particularly apartments and row homes, continued to face challenges in January, with significant inventory growth contributing to downward pressure on prices. While some areas like the City Centre and West districts saw slight price stability due to localized demand, the overall trend for these property types was negative. Apartment condominiums struggled the most with increased inventory levels and a reduced sales-to-new-listings ratio of 35%. This imbalance caused the benchmark price for apartments to drop nearly 8% year-over-year. As supply continued to outpace demand in this sector, prices are expected to face continued downward pressure in the short term. With over five months of supply in the apartment market, the outlook for this segment appears cautious unless significant changes in demand or supply occur in the coming months.